1500 after tax

A licensed inspector establishes that there is a dangerous level of lead in the residences accessible structural materials. PARCS works hard to maintain the Citys 1500 acres of open space and the team is devoted to providing organized recreation programs and activities for the community.

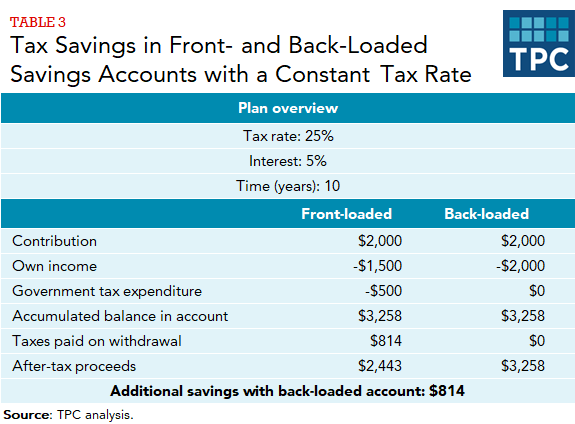

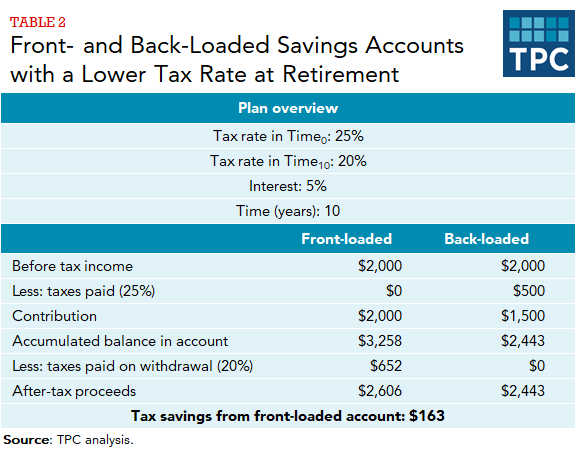

What S The Difference Between Front Loaded And Back Loaded Retirement Accounts Tax Policy Center

Individualists promote the exercise of ones goals and desires and to value independence and self-reliance and advocate that interests of the individual should achieve precedence over the state or a social group while opposing external.

. Luther survived after being declared an outlaw due to the protection of Elector Frederick the Wise. Find new and used cars for sale on Microsoft Start Autos. Washing machines selling for 1500 or less Water heaters selling for 1500 or less.

Any real property tax payments received after the tenth calendar day after the due date are considered late and interest will be charged as follows. Welsh Journals provides access to journals relating to Wales published between 1735-2007. Get a great deal on a great car and all the information you need to make a smart purchase.

The tax credit differs depending on the income tax year and the vehicle category which includes light-duty EVs light-duty electric trucks medium-duty electric trucks and heavy-duty electric trucks. EVs titled and registered in Colorado are eligible for a tax credit. Coupons Discounts and Rebates The sales price of an item includes all consideration.

Find many great new used options and get the best deals for 2021 Bluenose Schooner 100th Canada Special Designs 10 cents 14 Dimes at the best online prices at eBay. 2022 personal income tax rates and thresholds as published by the ATO. It can be found on any communication you receive from Flores.

13-2080 Tax Examiners Collectors and Preparers and Revenue Agents. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. Decedents who died on or after Oct.

It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. Deborah Ward used a tax reclaims firm to get money back on an old PPI tax claim Credit. Referred to as the dollar US.

College to pay 37M to local bakery after students alleged racism In a 2016 lawsuit the Ohio small business had accused the school of falsely accusing it of racial discrimination. A dependent is an individual whom a taxpayer can claim for credits andor exemptions. The 1991 Act 72 PS.

Also abbreviated US or US. The 78k salary example is great for employees who have standard payroll deductions and for a quick snapshot of the take home amount when browsing new job opportunities in Australia for those who want to compare salaries have non-standard payroll deductions of simply wish to produce a bespoke. Top 10 Home Business Tax Tips.

Dollar to distinguish it from other dollar-denominated currencies. 13-2081 Tax Examiners and Collectors and Revenue Agents. Although the German Peasants War of 15241525 began as a tax and anti-corruption protest as reflected in the Twelve Articles.

Small Business Tax Obligations. How Becoming an LLC Could Save Taxes Under the Tax Cuts and Jobs Act of 2017. Complete Schedule LP and enclose it with the tax return.

And Estate Tax Act of 1991 which applies to estates of. Individualism is the moral stance political philosophy ideology and social outlook that emphasizes the intrinsic worth of the individual. Your Participant ID PID is a nine digit number assigned to you when your account was created.

Tax Information Publication - 2022 Sales Tax Exemption Period on New ENERGY STAR Appliances Page 2. Example - a private company with an accounting period ending 30. Delivery is made after the sales tax exemption period.

Free shipping for many products. Dollar American dollar or colloquially buck is the official currency of the United States and several other countriesThe Coinage Act of 1792 introduced the US. For example the purchase of a light-duty EV in 2020-2021 is.

The United States dollar symbol. The PA Inheritance Tax was previously imposed by. Coral Gables woman out more than 3000 after scammers trick her using Zelle Laura Hernandez says this all started when she received a text message from scammers.

For WOTC-certified new hires working at least 120 hours employers can claim 25 of the first year wages paid up to 6000 for a maximum income tax credit of up to 1500. The presence of a printing press in a city by 1500 made Protestant adoption by 1600 far more likely. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter.

Search over 450 Welsh Journals. Millions of people were victims of being mis-sold Payment Protection Insurance PPI. See My Options Sign Up.

EV Tax Credit. 13-2099 Financial Specialists All Other 15-0000 Computer and Mathematical Occupations. On all unpaid and delinquent taxes the rate of 8 per annum is charged on the first 1500 of the delinquent payment and 18 per annum on any amount in excess of 1500.

9101 et seq was amended in 1994 for estates of decedents who died on or after July 1 1994 and again in 1995 for estates of decedents who died on or after Jan. After an authorized person de-leads the premises get a letter of compliance from a licensed inspector. A dependent is an individual such as a qualifying child whom a taxpayer can claim on his or her.

13-2090 Miscellaneous Financial Specialists. Dollar at par with the Spanish silver dollar divided. The main function of the Parks After School Recreation and Community Services Department is to offer the public access to well maintained green space to enjoy leisure recreation.

To qualify as fully complying with the credit. For 870000 homeowners with incomes up to 150000 it would mean savings up to 1500 and 290000 households with incomes between 150000 and 250000 would get 1000 in tax relief. The penalty will be doubled if accounts are filed late in 2 successive financial years beginning on or after 6 April 2008.

/cloudfront-us-east-1.images.arcpublishing.com/gray/4OWMLEQIGNGIHJO3MBDO6A4NL4.jpg)

Colorado Cash Back Q A Why Didn T I Get The Full Amount

What Is Line 15000 Formally Known As 150 On My Tax Return Cloudtax Simple Tax Application

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

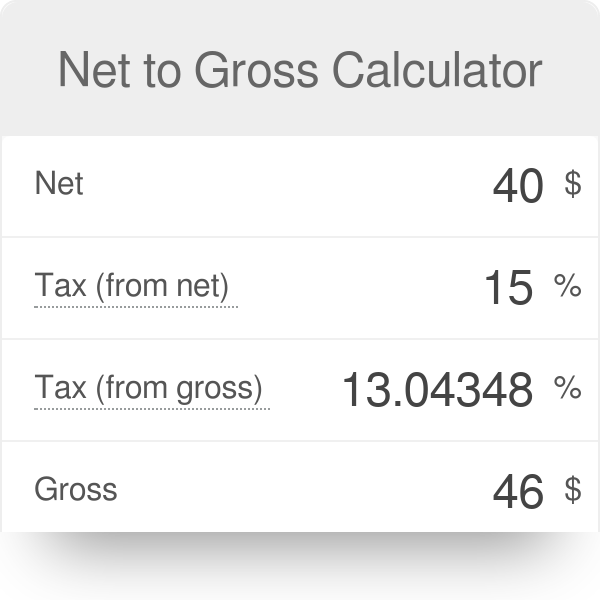

Net To Gross Calculator

Dor Unemployment Compensation

Pin On S P 500 Vs Corporate Profits After Tax Real Gdp

How To Calculate Net Pay Step By Step Example

Why We Re In A New Gilded Age Paul Krugman Dbq Essay Gilded Age Essay

California Paycheck Calculator Smartasset

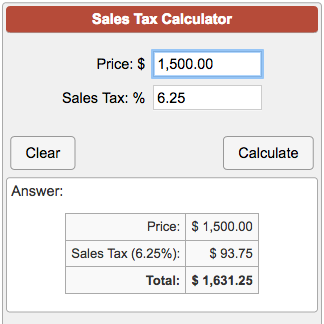

Sales Tax Calculator

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

What S The Difference Between Front Loaded And Back Loaded Retirement Accounts Tax Policy Center

Call Center Set Up In Colorado For Tabor Refund Checks 55 Of Checks Mailed Out Have Been Cashed As Of Aug 17

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Tpus4mswe6hmbm

Sales Tax Calculator

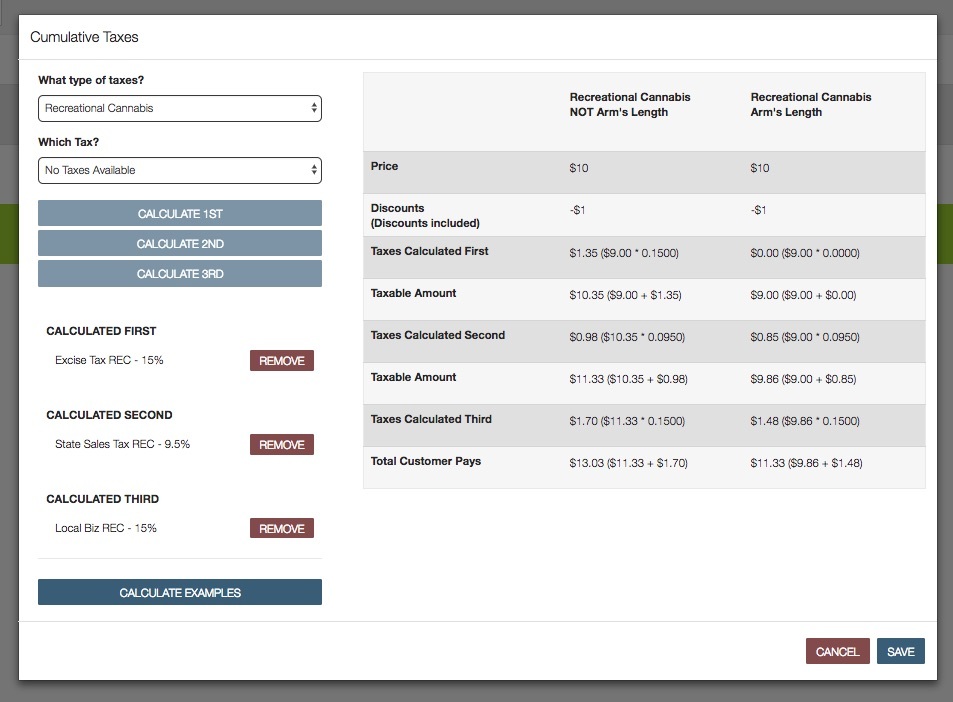

How To Calculate Cannabis Taxes At Your Dispensary